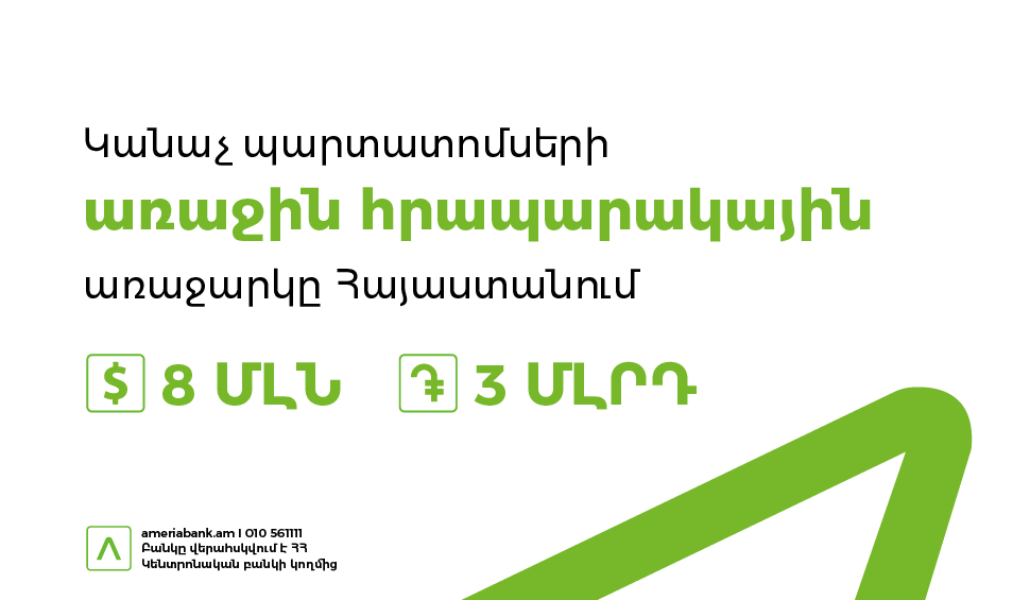

Ameriabank is the First in Armenia to Place Green Bonds via Public Offering

Support A1+!14.02.22 Ameriabank announces public placement of nominal, coupon, book-entry bonds with the total volume of USD 8 million and AMD 3 billion during the period from February 14 to April 22, 2022, inclusive. It is the first ever placement of green bonds via public offering in Armenia.

The bonds’ maturity is 27 months, with the coupon rate of 3.5% for USD bonds, and - 9.5% for AMD bonds. The par value of the bonds is USD 100 and AMD 100,000. The coupon periodicity is 3 months.

The proceeds green bonds will be used to finance “green assets” as per “Green Bond Framework”, which implies projects that provide clear environmental benefits and promote transition to low-carbon, climate resilient and sustainable economies. Committed to its strategy of managing environmental risks, Ameriabank is continuously increasing the green asset portfolio and funding of projects aimed at designing long-term sustainable solutions.

Please follow the links below for the program prospectus registered by the Central Bank, supplements thereto, and the final terms of issues:

for AMD bonds: here

for USD bonds: here

Potential investors can obtain the hard copies of the bond prospectus and supplements to it at the head office of Ameriabank CJSC (address: 2 Vazgen Sargsyan St., Yerevan, 0010, RA).

We would like to remind that Ameriabank was the first institution in Armenia to issue and place green bonds in 2020 via a private placement, with the total value of Euro 42 million.

Ameriabank is a dynamically developing bank and one of the major and most stable financial institutions in Armenia with clearly formulated digital agenda. Ameriabank CJSC is a universal bank offering corporate, investment and retail banking services in a comprehensive package of banking solutions. Based on 2021 results, Ameriabank is the market leader by all key financial indicators, with assets exceeding AMD 1 trillion.